change in net working capital dcf

Add back the depreciation and amortization charges. O The increase in currents assets such as accounts receivables or inventory would lead to lower cash flow then.

How To Use Discounted Cash Flow Time Value Of Money Concepts

The DCF calculation would give you Enterprise Value to which you would then in order to get Equity value.

. The goal is to. One is to use the change in non-cash working capital from the year 307 million and to grow that change at the same rate as earnings are expected to grow in the future. In Scenario A the change in invested capital was 25m more for an increase of 5m.

Say 5 then this will be 6k of your profits so you add 80k to the price 168 million plus the tax of selling 168k. If a company purchased inventory with cash there would be no change in working capital because inventory and cash are both current assets. On the Cash Flow Statement the Change in Working Capital is defined as Old Working Capital New Working Capital where Working Capital.

If youre asking whether you include cash in the CA to get to change in net working capital the answer is no. Net Working Capital Formula. Changes in Net Working Capital Working Capital Current Year Working Capital Previous Year Or Change in a Net Working Capital Change in Current Assets Current Assets.

Change in Net Working Capital Net Working Capital for Current Period Net Working Capital for. Cash is the result of a DCF ie cash flow therefore you dont. There are a few different methods for calculating net working capital depending on what an analyst wants to include or exclude from the value.

The entire intuition behind CA-CL is to arrive at how cash has changed over the. Change in Working Capital Summary. Change in Net Working Capital is calculated using the formula given below.

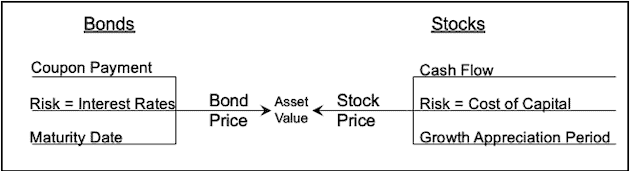

The Discounted Cash Flow also normalizes the historical financial statement data and makes projectionsforecasts on data that is not stabilized andor has unusual expectations for future. ΔWorking Capital Net change in the Working Capital. Converting Accounting Earnings into Cashflows.

Working Capital changes would affect the cash flow in following ways. Although they are considered expenses from an accounting perspective. Calculate the change in.

Similarly change in net working capital helps us to understand the cash flow position of the company. BRC Change In Working Capital as of today August 12 2022 is -155 Mil. However cash flow would be reduced by.

However as we mentioned. Thats why the formula is written as - change in working capital. In the DCF method change in working capital would exclude change in cash cash equivalents and current financial debt and include non financial items such as change in inventories.

Net Present Value 36m Discounted Cash Flow Internal Rate of Return 19m Discounted Cash Flow Annuities and Perpetuities 23m. The Change in Net Working Capital NWC section of the cash flow statement tracks the net change in operating assets and operating liabilities across a specified period. The first step might be to use the change in non-cash working capital 1778 and project that at the same growth rate of earnings growth into the future.

Since the change in working capital is positive you add it back to Free Cash Flow. Plus tax on profits from investment portfolio also gets added to the capital. Changes in NWC impact both the levered free cash flow the companys cash after meeting its obligations and the unlevered free cash flow the cash that is available before debt and tax.

In this video I cover the different ratios tha. How do you project changes in net working capital NWC when building your DCF and calculating free cash flow. If youre calculating change in working capital for the purpose of a DCF or Net Operating Assets - then dont include cash.

Discounted Cash Flow Dcf Valuation Model 7 Steps

Net Working Capital What Is It And How Is It Used Lutz M A

Step By Step Guide On Discounted Cash Flow Valuation Model Fair Value Academy

Dcf And Pensions Enterprise Or Equity Cash Flow The Footnotes Analyst

What Is Net Working Capital Daily Business

Dcf Model Discounted Cash Flow Valuation Efinancialmodels

Free Discounted Cash Flow Templates Smartsheet

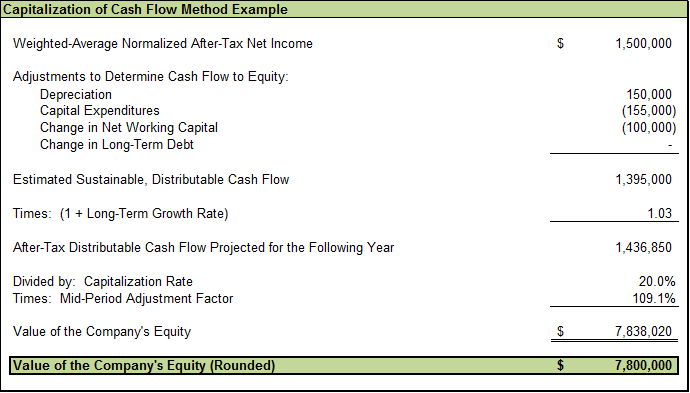

An Explanation Of Income Approach To Valuation Capitalization Of Cash Flow Method Marcum Llp Accountants And Advisors

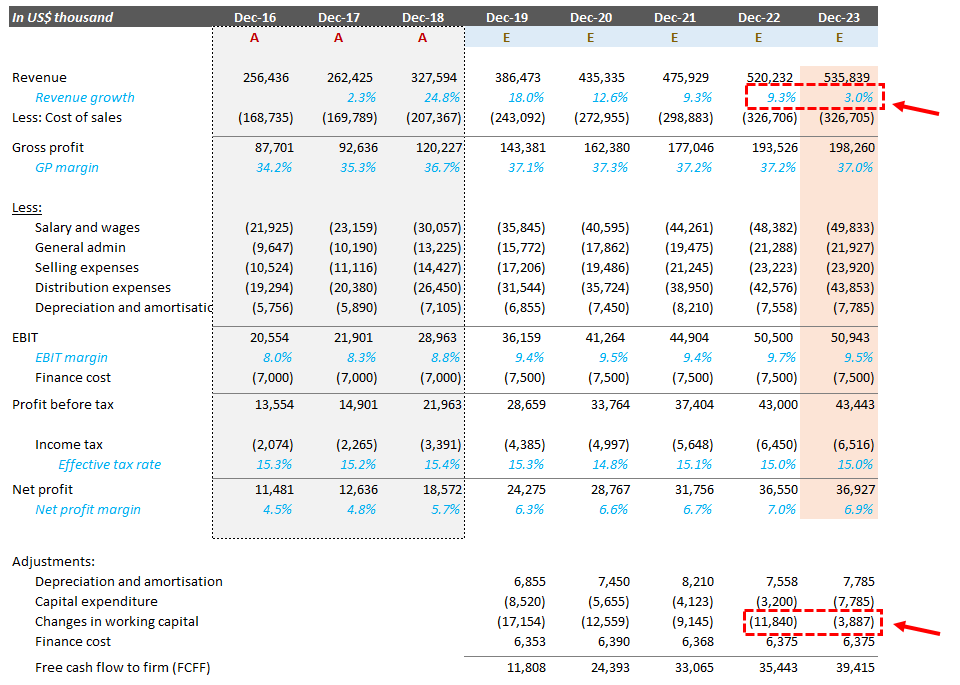

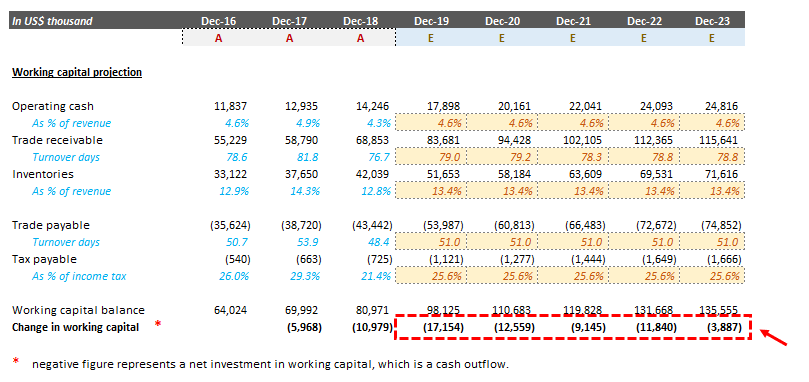

Assignment 2 Task 3 Jbinvestments

Discounted Cash Flow Analysis Street Of Walls

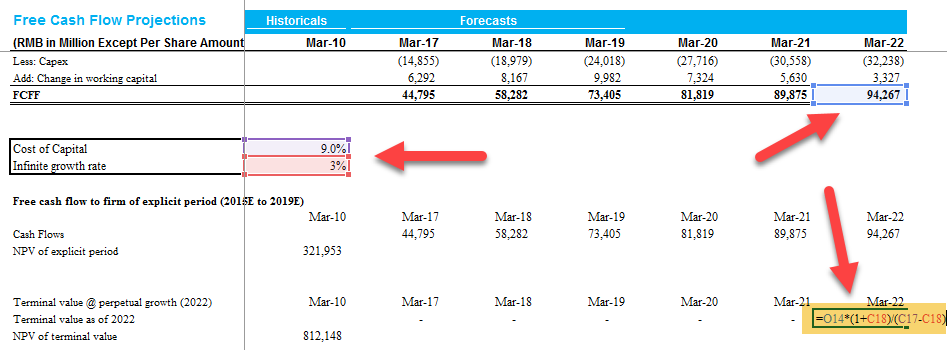

Dcf Craft Part 1 2 Of 5 Free Cash Flow Projection Lmv Investcafe Livejournal

The Ultimate Guide To Advanced Discounted Cash Flow Analysis Dcf How To Value A Company Stockbros Research

Step By Step Guide On Discounted Cash Flow Valuation Model Fair Value Academy

Change In Net Working Capital Nwc Formula And Calculation

:max_bytes(150000):strip_icc()/dotdash_Final_What_Changes_in_Working_Capital_Impact_Cash_Flow_Sep_2020-01-13de858aa25b4c5389427b3f49bef9bc.jpg)

What Changes In Working Capital Impact Cash Flow

Learn How Our Reverse Dcf Model Works

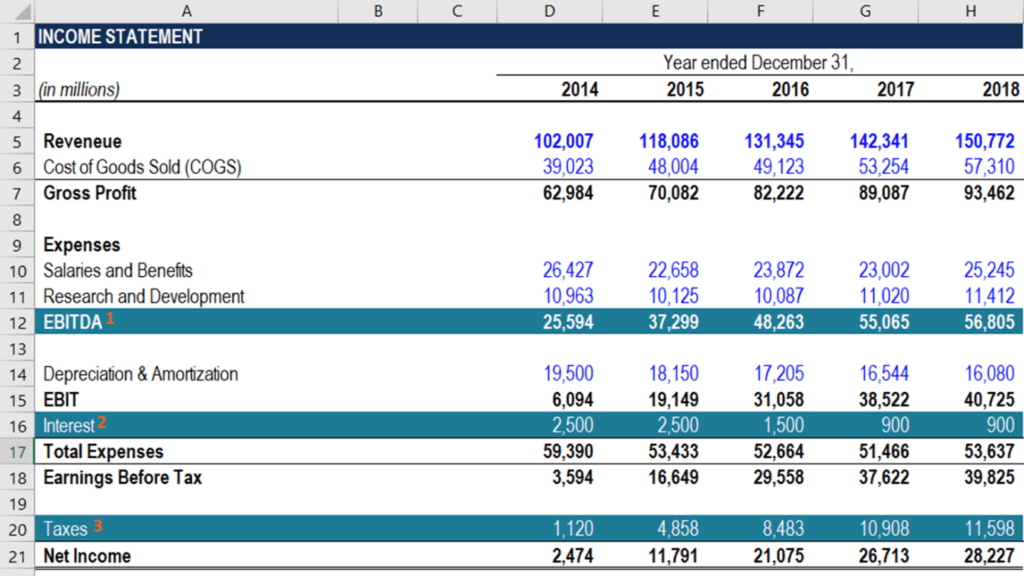

How To Calculate Fcfe From Ebitda Overview Formula Example

11 Of 14 Ch 10 Change In Net Working Capital Nwc Example Youtube